how much does illinois tax on paychecks

Payroll benefits and everything else. Forms required to be filed for Illinois payroll are.

State Withholding Form H R Block

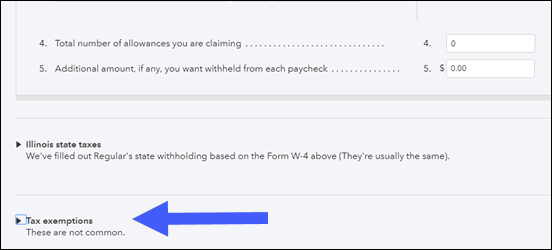

Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. What is the tax rate in Illinois for paychecks. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

How Much Does Illinois Tax On Paychecks. IL-941 Illinois Withholding Income Tax Return Quarterly due either the last day of the month. Illinois has a flat income tax of 495 which means everyones income in illinois is taxed at the same rate by the state.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. The wage base is 12960 for 2022 and rates range from 0725 to 7625. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

Personal Income Tax in Illinois. 2022 Federal Tax Withholding Calculator. No Illinois cities charge a local income tax on top of the state income.

This is a projection based on information you provide. Why Gusto Payroll and more Payroll. Set up a free consultation with one of our experts.

How To Calculate Taxes. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. No state-level payroll tax.

Although you might be tempted to take an employees earnings and multiply by 495 to come. Gusto offers fully integrated online HR services. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

No Illinois cities charge a local income tax on top of the. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. Automatic deductions and filings direct deposits W-2s and 1099s.

Ad 1-800Accountant provides tax and accounting services tailored to your state and industry. Employers can find the exact amount. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

According to the Illinois Department of Revenue all incomes are created. This 153 federal tax is made up of two parts. Personal income tax in Illinois is a flat 495 for 20221.

Accounting services from 125 a month. You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

This calculator is a tool to estimate how much federal income tax will be withheld. Therefore fica can range between 153 and 162. She uses this extensive experience to answer your.

Fast easy accurate payroll and tax so you can.

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

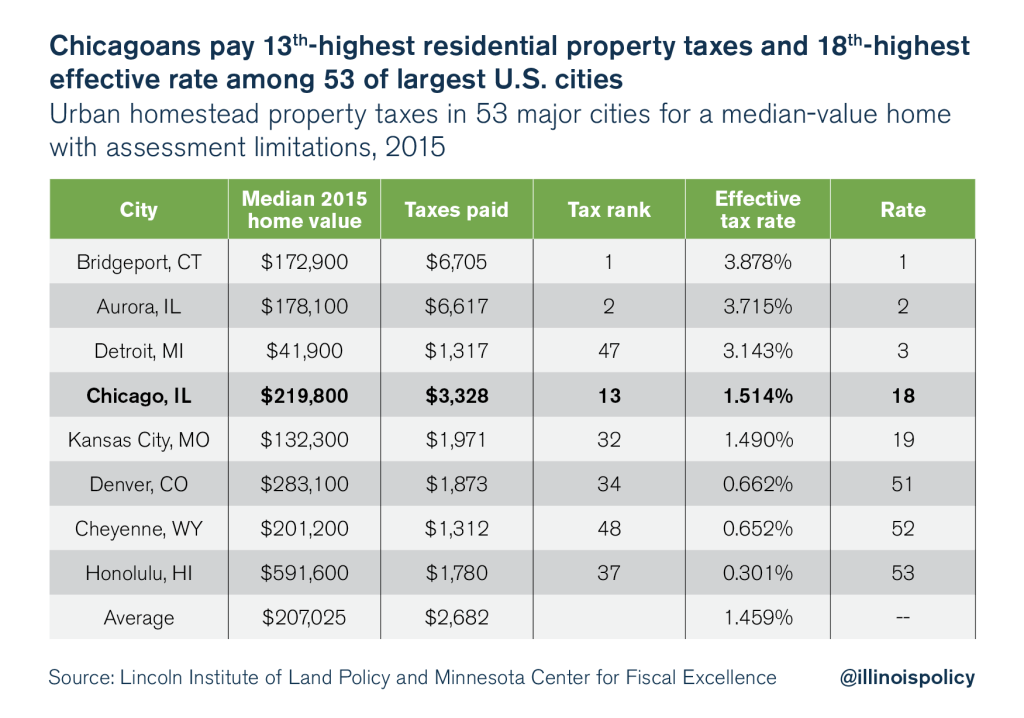

Illinois Is A High Tax State Illinois Policy

How To Setup An Employee Do Not Hold Any Federal And State Tax Witholding In Qbo Employee Lives Overseas And Claims Feie Foreign Earned Income Exclusion

Illinois Paycheck Calculator Smartasset

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Illinois Paycheck Calculator Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Dying For A Paycheck How Modern Management Harms Employee Health And Company Performance And What We Can Do About It Pfeffer Jeffrey 9780062800923 Amazon Com Books

What Are Employer Taxes And Employee Taxes Gusto

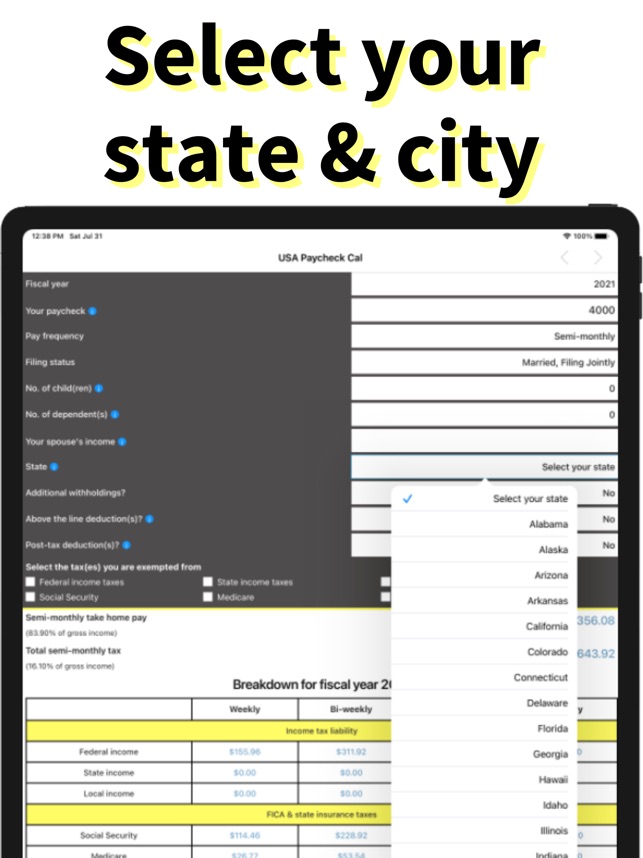

Usa Paycheck Calculator On The App Store

Illinois Income Tax Rate And Brackets 2019

Rep Kinzinger Votes To Overhaul America S Tax Code U S House Of Representatives

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Wage Bargaining Raises And Back Pay Ga Pga Taxation Community Read And Fair Tax Q A Graduate Employees Organization At Uiuc