per capita tax revenue

Queensland recorded the highest annual growth in state and local combined taxation revenue per capita up 105 which exceeded the average of 66. Total US government estimated revenue for 2022 is 798 trillion including a budgeted 417 trillion federal a guesstimated 226 trillion.

Tax Revenue As Share Of Gdp Spain Statista

Per capita values are calculated by dividing the estimated population into total revenues per city per fiscal year.

. GDP and per capita GDP 2019. This is a table of the total federal tax revenue by state federal district. This will give you tax revenue per capita in a given year.

State government tax revenue 2021 by state. Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing. Per capita US.

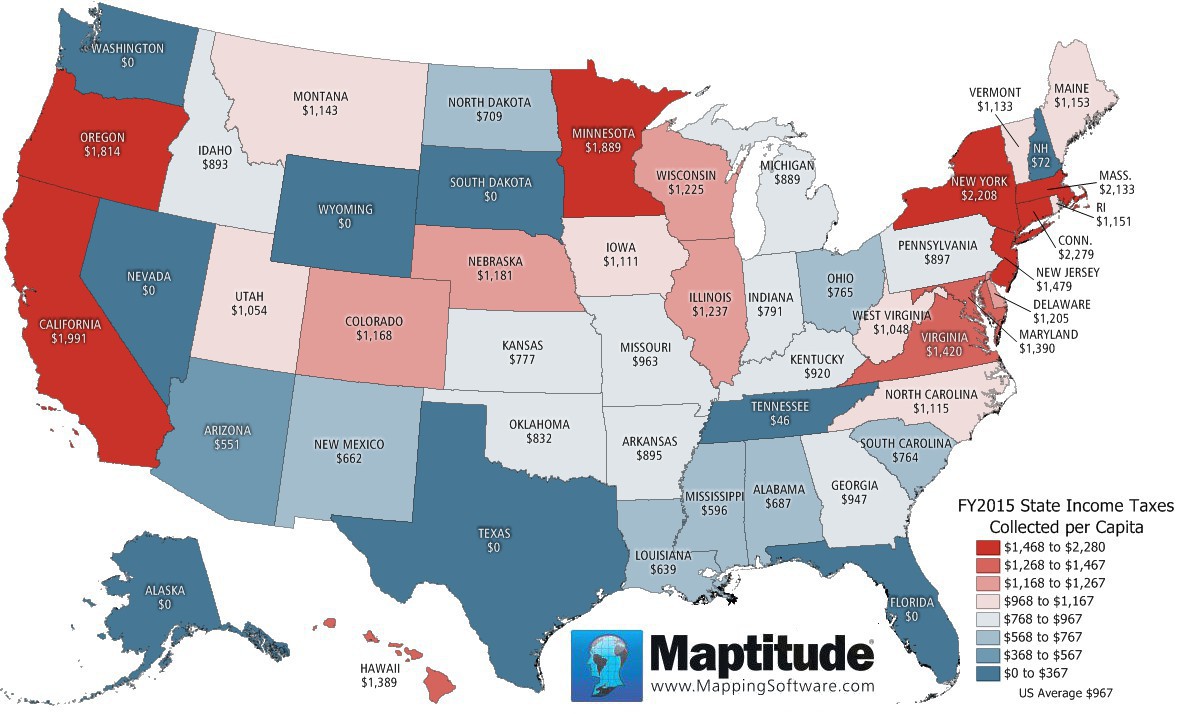

Per capita income helps determine the average per-person income to evaluate the standard of living for a population. US Per Capita Government Revenue. Of the states that tax wage income the lowest collections per capita in fiscal year 2018 were in North Dakota 485 New Mexico.

US Per Capita Government Revenue. Remember that tax revenue per capita refers to income tax that is tax. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

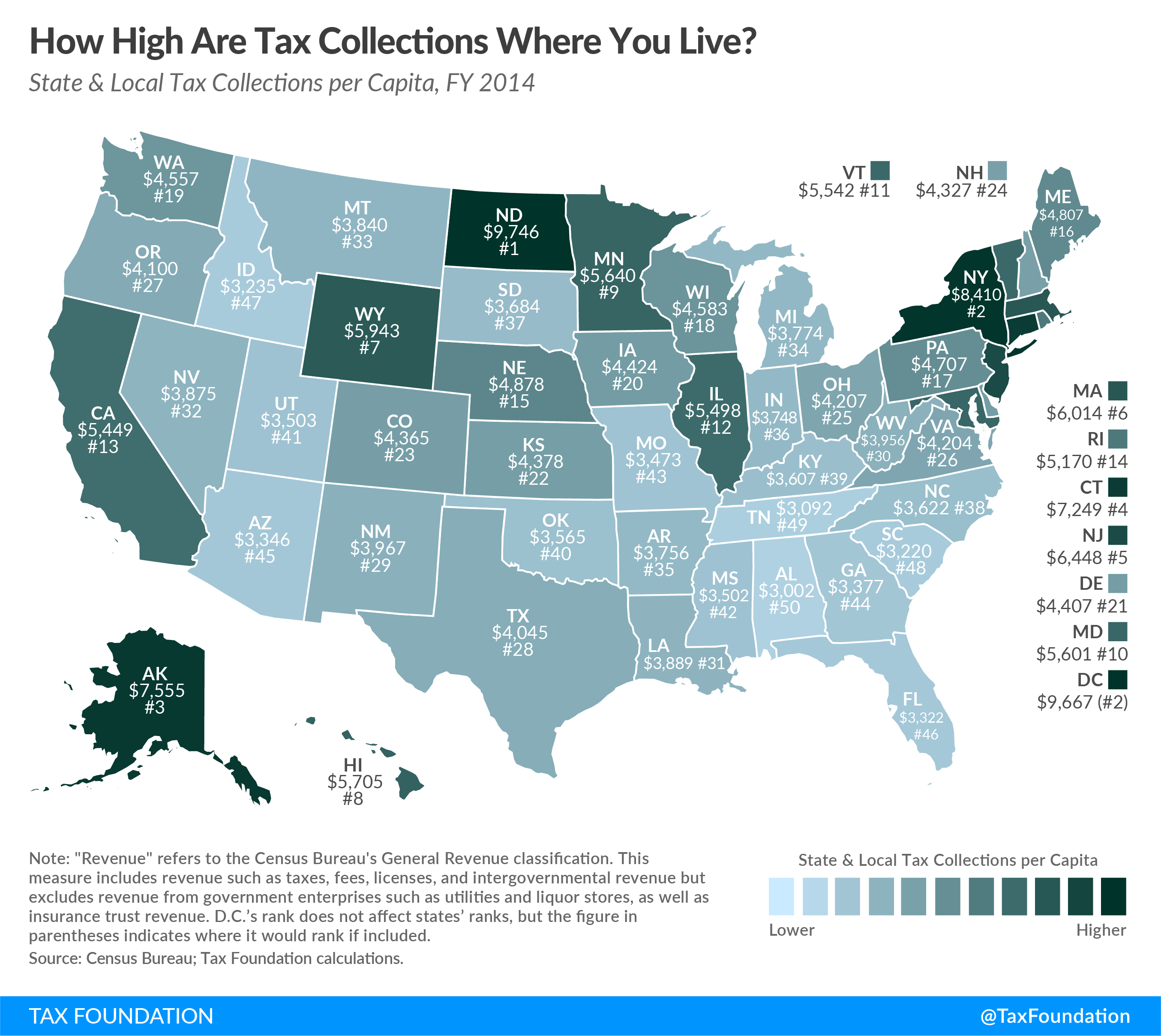

Tax Policy Center. New York has the highest per capita local general revenue from its own sources at 5463 while Vermont has the lowest at 1230 per capita. FTA Revenue Estimating Conferences.

The tax percentage for each country. Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the. Government annual receipts 2022 by quarter.

City Revenues Per Capita. State and local tax revenue 1977-2019. The Occupation Tax is an Act 511.

Research and Tax Rates. What is Act 511 in PA. Municipalities and school districts were given the right to collect a 1000.

And not the entire revenue collected by the IRS. Per capita values are based on population estimates from the. For illustrative purposes market income total.

New Jersey has the highest per. Which states have lowest tax collections per capita. Total US government estimated revenue for 2022 is 793 trillion including a budgeted 444 trillion federal a guesstimated 218 trillion.

A table listing total GDP expenditure-based share of Canadian GDP population and per capita GDP in 2019. This article lists countries alphabetically with total tax revenue as a percentage of gross domestic product GDP for the listed countries. Divide the income tax revenue by the taxable population.

Rankings of State and Local Per Capita.

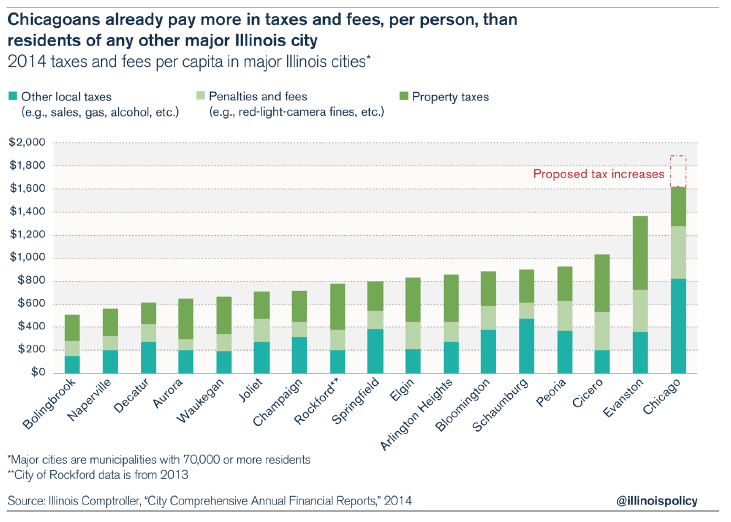

Busting The Myth That Chicago Taxes Are Low Illinois Policy

State And Local Tax Revenue Per Capita And As A Percentage Of Personal Download Table

Oecd Tax Revenue As A Share Of Gdp Per Capita Tax Policy Center

National Tax Day April 18 2022

Who Are The Givers The Northeast Subsidizes Federal Spending Rockefeller Institute Of Government

File Us States By Federal Tax Revenue Per Capita Svg Wikimedia Commons

Tax Burden Per Capita Other State Austin Chamber Of Commerce

Non Tax Revenue Oklahoma Policy Institute

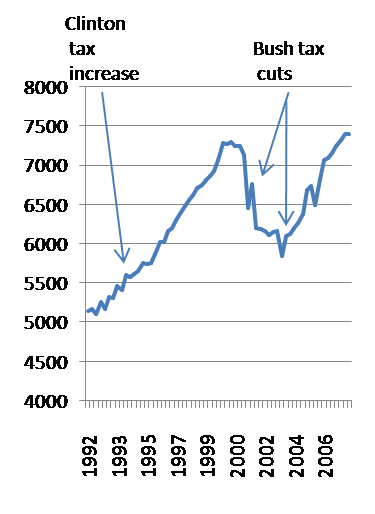

Taxes And Revenues Another History Lesson The New York Times

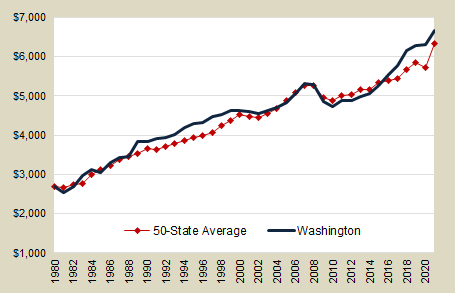

State Local Government Taxes Per Capita Office Of Financial Management

Trump S Tax Numbers Just Don T Add Up

Tax Burden Per Capita Other State Austin Chamber Of Commerce

Indiana Tax Revenues For Expenditures Compared To Other States

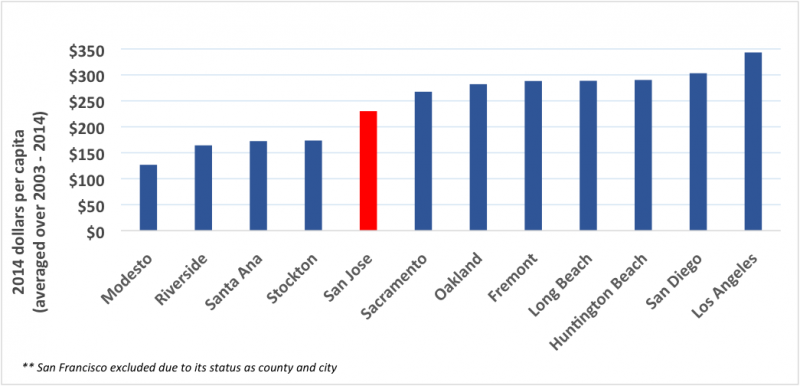

Strengthening The Budget Of The Bay Area S Largest City Spur

How Much In State Taxes Each State Collects Per Person

File Us States By Average Per Capita State Tax Revenue Svg Wikimedia Commons

Michigan Ranked 31 Nationwide For Amount Of Taxes Per Capita Drawing Detroit